A For April 2021 No interest is charged for delayed submission up to 9th June whereas 9 of reduced interest is charged between 10th June and 9th July. Jacie Tan - 2nd February 2021.

Monthly Gst Filing In Malaysia Goods And Services Tax Gst

You can start selling.

. Prepare your company financial report compliance with Malaysia rules and. We have an essay service that includes plagiarism check and proofreading which is done within your assignment deadline with us. GST has replaced the earlier VAT applicable.

Indonesia Canada the UK China Malaysia and Saudi Arabia. Bookmark this page now. If a company files their annual return 3 months after the deadline the late filing penalty will be S300.

FOMCA Welcomes Reintroduction Of GST. Legal drafting is an essential skill for lawyers - it involves learning the art to draft Contracts Petitions Opinions Articles. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

Below are the sample leave extension letter applications. Extensions of the filing deadline are not permitted in India. For any delayed submission of PMT-06 by QRMP taxpayers for April 2021 and May 2021 interest relief has been provided as follows.

The rate of GST will depend on the items you are selling. Quality problems can be identified much sooner b. We offer assignment help on any course.

ACRA and IRAS take non-compliance seriously. If you sell goods. Begin typing to search use arrow keys to navigate use enter to select.

Leave extension due to my parents health problem. To The Manager Subject. Now these taxes have been replaced by GST.

Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year Personal Tax Relief 2021. Review the Balance Sheet refer appendix 2 to determine if GST has been accounted for and if so how much GST will be paid to the ATO. GOI that offers online solution for application submission as well as for.

E-Business Visa and e-Tourist visa may be granted multiple times in a year for a maximum period of 1 year with multiple entry facility. Currently this is the applicable GST rate on cakes. RON97 and Diesel in Malaysia and a chart that shows the movement of fuel prices across a 6-week period.

For example if you make and sell cakes to bakeries then you must charge 18 GST. Here are the details of Late Fees and Interest under GST. If it exceeds more than 3 months after the deadline the penalty will be S600.

Appendix 2 Clearwater Pty Ltd 25 Spring Street Blackburn The biggest advantage of working in small batches is that. Earlier VAT Service Tax applied on freelancers. This ensures all instructions have been followed and the work submitted is original and non-plagiarized.

We offer assignment help in more than 80 courses. The deadline for filing annual tax returns is 30 November of the Year of Assessment. Application for Leave Extension due to family health issue.

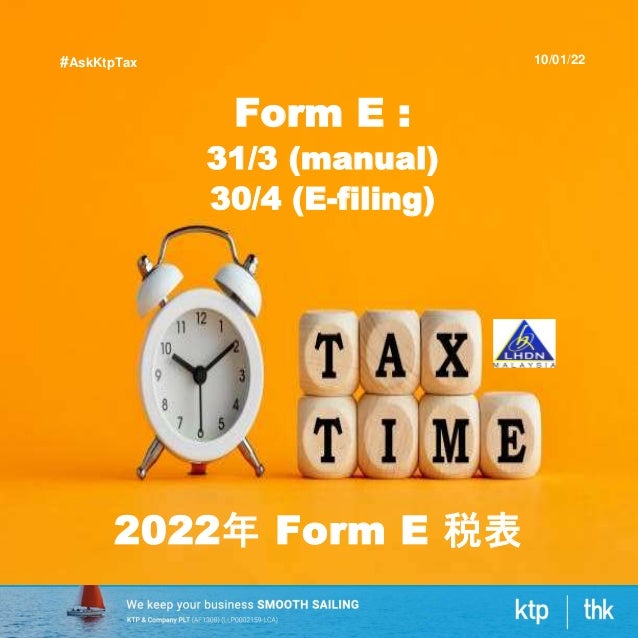

LHDN has reminded that the submission deadline for this years tax return forms is set on 30 April 2022 manual and 15 May 2022 e-Filing.

Gst Return Due Date List Jan 2020 Billing Software Accounting Software Due Date

Extension Of Deadline 2 Months For Filing Malaysia Income Tax 2020

Monthly Gst Filing In Malaysia Goods And Services Tax Gst

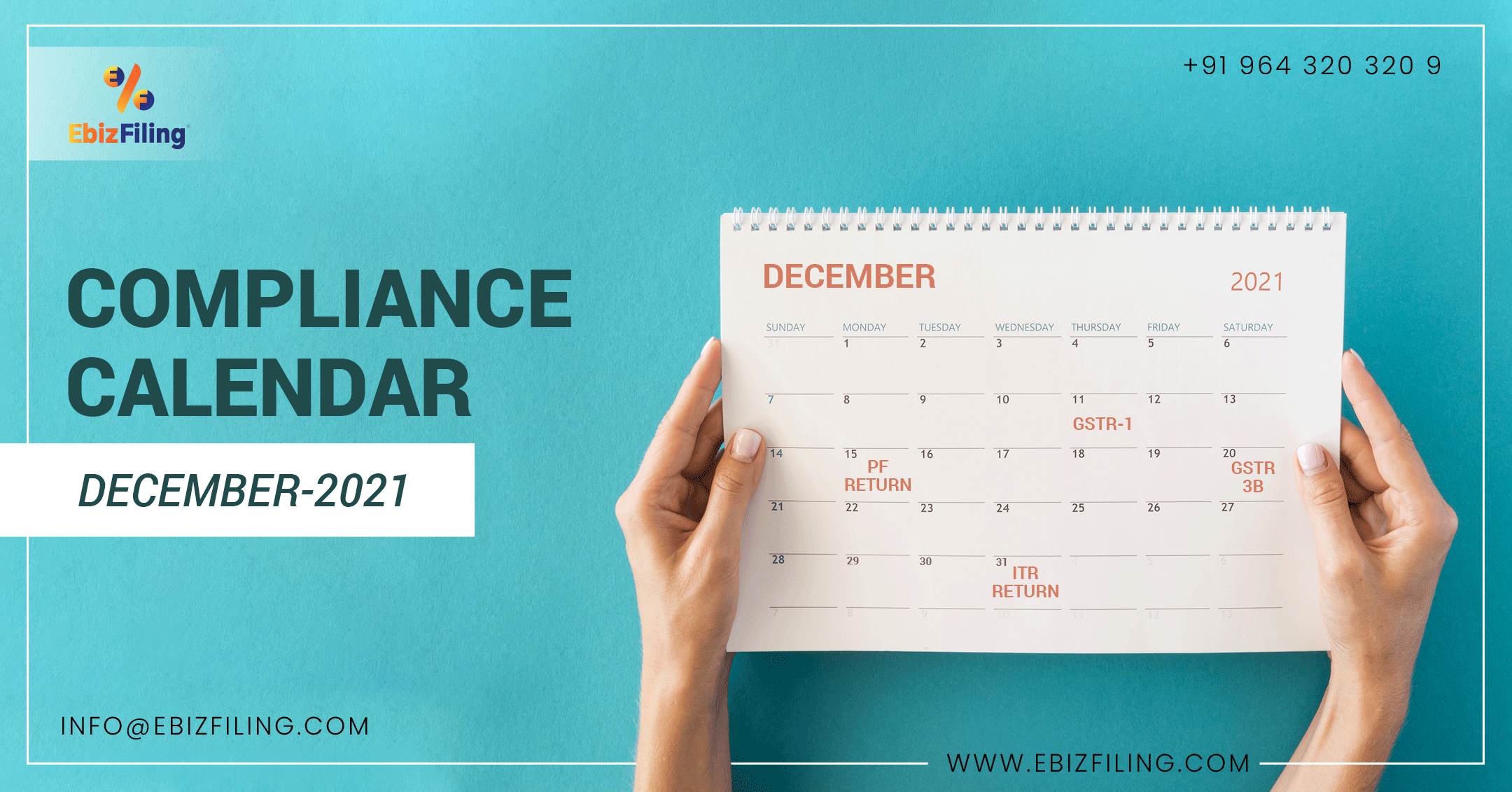

Tax Compliance And Statutory Due Dates For April 2022 Ebizfiling

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates פייסבוק

India Gst What Are The Different Types Of Gst Returns

Tax Compliance And Statutory Due Dates For The Month Of December 2021

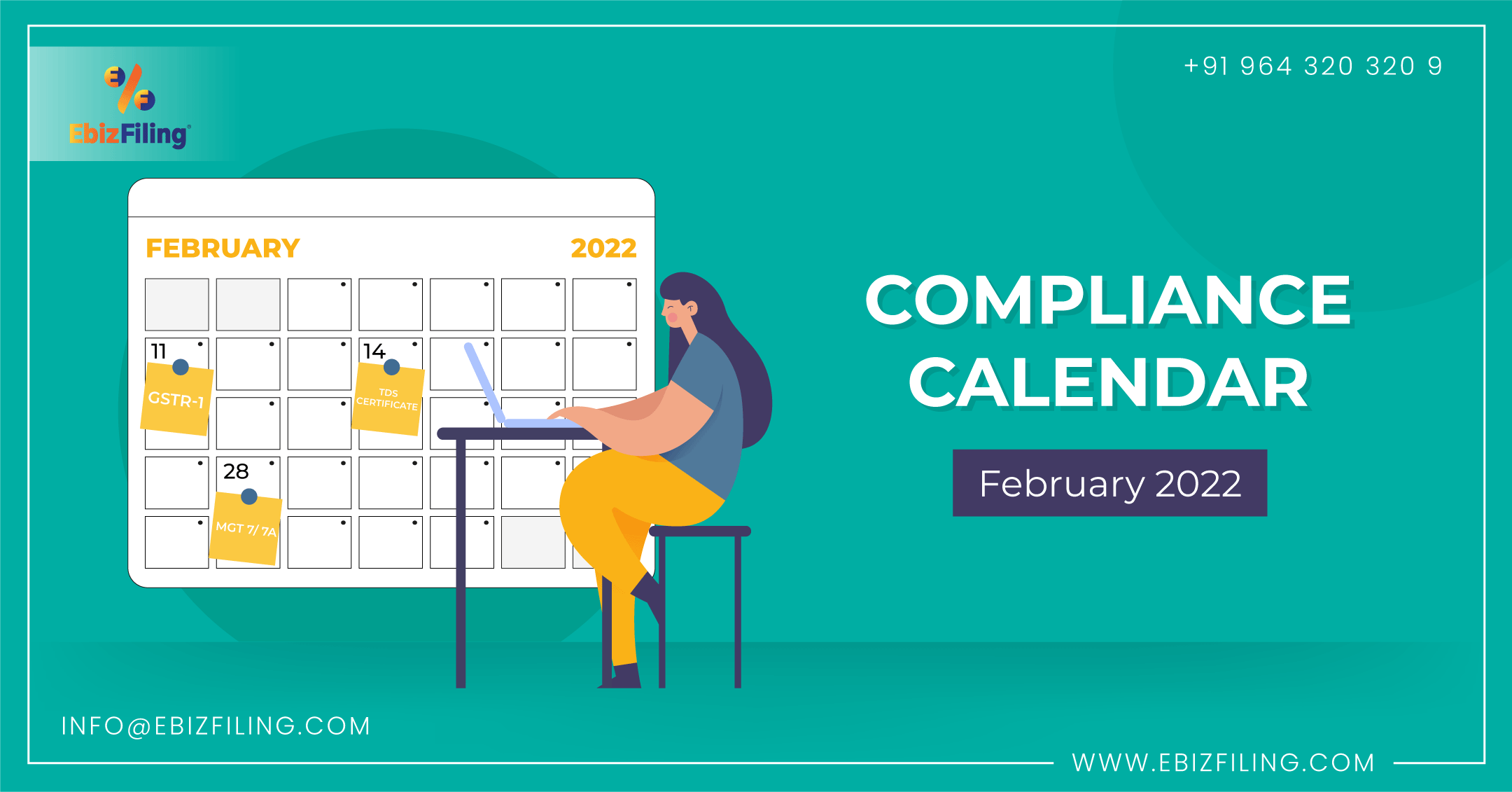

Tax Compliance And Statutory Due Dates For February 2022 Ebizfiling

Gst Submission Deadline Malaysia Madalynngwf

Preparing Vat Returns And Gst Returns Xero Blog

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Requirements Penalties In Malaysia Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

Tax Compliance And Statutory Due Dates For The Month Of November 2021

Only 20 Of Gst Returns For Fy18 Filed A2z Taxcorp Llp

Tax Filing Deadline 2022 Malaysia

Iras Overview Of Gst E Filing Process